Roth ira growth calculator

Schwab Has 247 Professional Guidance. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Historical Roth Ira Contribution Limits Since The Beginning

Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool.

. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. The amount you will contribute to your Roth IRA each year.

This calculator assumes that you make your contribution at the beginning of each year. Explore Choices For Your IRA Now. Simplify The Road To Retirement.

The amount you will contribute to your Roth IRA each year. Ad It Is Easy To Get Started. This calculator assumes that you make your contribution at the beginning of each year.

For 2022 the maximum annual IRA. Traditional or Rollover Your 401k Today. The amount you will contribute to your Roth IRA each year.

Creating a Roth IRA can make a big difference in your retirement savings. Creating a Roth IRA can make a big difference in your retirement savings. This calculator assumes that you make your contribution at the beginning of each year.

For 2022 the maximum annual IRA. This calculator assumes that you make your contribution at the beginning of each year. This calculator assumes that you make your contribution at the beginning of each year.

The amount you will contribute to your Roth IRA each year. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Learn More About Schwab IRAs And Start Investing Today.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. This calculator assumes that you make your contribution at the beginning of each year. All fields are required.

There are two basic types of individual retirement accounts IRAs. As of January 2006 there. Ad Do Your Investments Align with Your Goals.

For 2022 the maximum annual IRA. It is important to. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

Make a Thoughtful Decision For Your Retirement. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Explore Your Choices For Your IRA.

Get Up To 600 When Funding A New IRA. For the purposes of this. The amount you will contribute to your Roth IRA each year.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. This calculator assumes that you make your contribution at the beginning of each year. Find a Dedicated Financial Advisor Now.

Ad Open an IRA Explore Roth vs. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. A Roth IRA is a fantastic vehicle for saving for retirement as it enjoys tax free growth and tax free distributions as opposed to a Traditional IRA that receives a tax deduction for funds.

Get Up To 600 When Funding A New IRA. The calculator will estimate the monthly payout from your Roth IRA in retirement. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Traditional IRA Calculator Calculate your earnings and more An IRA can be an effective retirement tool. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Married filing jointly or head of household. This calculator allows you to enter your annual deposit amount in Before Tax dollars so that the after tax deposit amount is automatically computed for you. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

Ad Do Your Investments Align with Your Goals. This calculator assumes that you make your contribution at the beginning of each year. It is important to.

The maximum annual IRA contribution. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. It is important to.

Find a Dedicated Financial Advisor Now. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad Opening an IRA May Help Meet Goals of Investing for Income or Growth.

This calculator assumes that you make your contribution at the beginning of each year. It is important to.

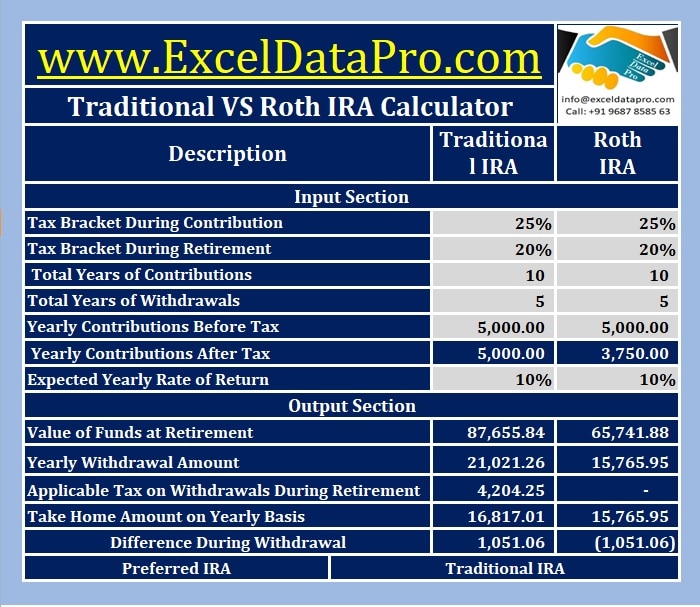

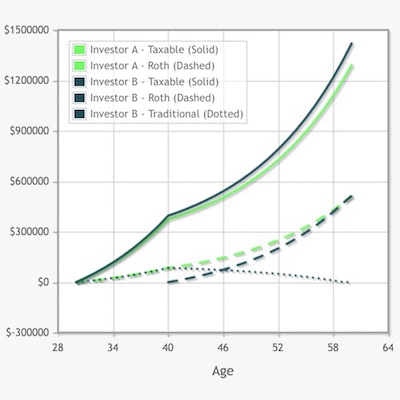

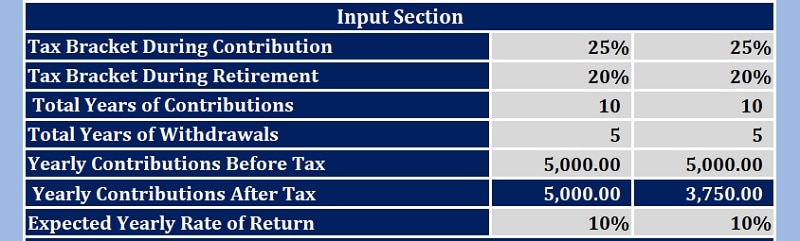

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Contributing To Your Ira Start Early Know Your Limits Fidelity

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The Benefits Of A Backdoor Roth Ira Financial Samurai

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Why You Should Get A Roth Ira Nextadvisor With Time

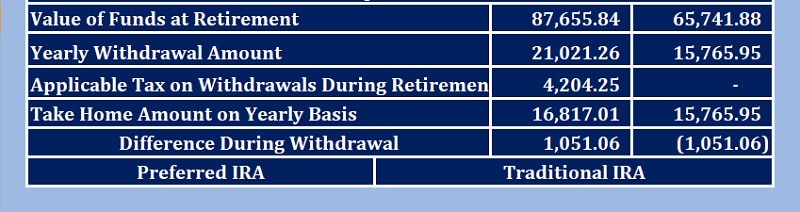

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Ira Calculator See What You Ll Have Saved Dqydj

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Pennies And The Backdoor Roth Ira The White Coat Investor Investing Personal Finance For Doctors Roth Ira Ira White Coat Investor

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Pin On Parenting

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Vs Roth Ira Calculator